Case Study: Insurance Transformation — Global Claims Renewal at Scale

Overview

A leading global insurer initiated a multi-year Global Claims Transformation Program to overhaul its claims operations. Legacy systems, manual workflows, and inconsistent practices across regions (Australia, North America, Europe) resulted in higher costs, slow turnaround times, and uneven customer experiences.

The program required coordinating more than 30 business and technology initiatives, with an estimated budget of $60M and ambitious benefit targets. Success meant not only modernising systems but also aligning stakeholders across multiple geographies and instilling an innovation culture.

Transformativ was engaged to design and deliver the transformation end-to-end, providing program leadership, governance, and execution across people, process, and technology.

The Challenge

-

Complex Global Landscape: Regional variations created fragmented claims processes and technology stacks.

-

Customer Experience Gaps: Slow claims handling and lack of digital channels impacted customer trust and satisfaction.

-

High Operating Costs: Manual processes drove inefficiency and duplication.

-

Change Management Risk: Employees across multiple geographies needed to adopt new systems and ways of working.

Insurers worldwide face similar pressures — rising customer expectations, increasing claims costs, and the demand for consistent digital experiences (Deloitte Insurance Outlook).

The Approach

1. Comprehensive Program Design

-

Defined four core streams: Digital Claims (customer portals, mobile apps), Payments Automation, Operational Excellence (process redesign and organisational change), and Supply Chain Optimisation.

-

Built business cases and ROI models tying each initiative to financial and customer outcomes.

2. High-Performing Team

-

Assembled a cross-functional team of ~90 specialists (project managers, UX designers, developers, analysts, change managers).

-

Fostered co-design with frontline claims teams to ensure adoption and practicality.

3. Agile Delivery & Scaled Governance

-

Introduced a Scaled Agile (SAFe) framework across global teams.

-

Ran quarterly planning increments and cross-team syncs.

-

Established governance via C-suite steering committees and risk forums.

-

Balanced speed of agile delivery with the rigour required for global oversight, a best-practice approach in large insurance transformations (Swiss Re Institute).

4. Technology & Innovation

-

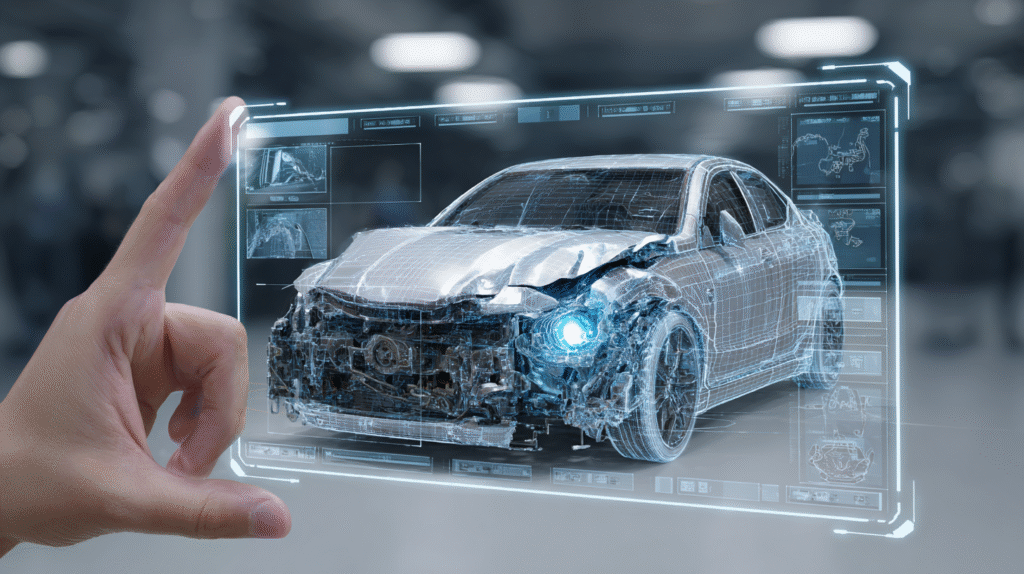

Piloted AI for auto-assessing simple claims (e.g., image recognition for car damage).

-

Applied analytics to predict fraud and improve claims outcomes.

-

Migrated applications to AWS/Azure and deployed SaaS platforms for scalability.

-

Introduced new vendor models to access niche technology talent.

5. Stakeholder Engagement & Change

-

Ran workshops with regional claims leaders to align priorities.

-

Engaged frontline claims officers for user feedback on new tools.

-

Rolled out a comprehensive change plan (training, communications, user champions).

-

Embedded a culture of innovation and agile ways of working.

The Outcome

The transformation delivered beyond expectations, realising $213M+ in financial benefits, more than three times the program cost.

Key results included:

-

Digital Claims Journey: Customers could lodge and track claims online. Processing time for simple claims dropped from weeks to days. Customer NPS increased significantly.

-

Efficiency & Speed: Cycle times for certain claims improved 30–40%. Payments automation freed up staff to focus on complex cases.

-

Global Consistency: Consolidated multiple legacy systems into a unified global claims platform, enabling cross-regional analytics.

-

Culture of Innovation: AI pilots proved successful and inspired further transformation initiatives. Teams adopted agile methods, increasing responsiveness to change.

The program contributed directly to improved cost ratios and stronger customer retention. It also positioned the insurer in line with global leaders leveraging technology to reinvent claims (McKinsey Global Insurance Report).

Insights & Lessons

-

Claims are the insurer’s moment of truth. Transforming claims impacts cost, customer loyalty, and brand trust simultaneously.

-

Scaled Agile works globally when paired with strong governance. It provided speed without losing control.

-

Technology alone is insufficient. Embedding AI, analytics, and digital tools succeeded because change management and user adoption were prioritised.

-

Culture change is as valuable as financial results. The program left behind a more agile, innovative organisation.

Key Highlights

-

Delivered >$213M benefits

-

30–40% faster claims cycle times

-

Digital claims journey launched globally

-

AI pilots for claims assessment & fraud detection

Claims are the core of customer trust in insurance. Transformations of this scale show that digitisation, governance, and culture change can deliver both efficiency and loyalty.

At Transformativ, we partner with insurers to deliver global transformation programs that reduce cost, improve customer experience, and instil innovation.

👉 Learn more about our Insurance & Risk Transformation Services.